Mortgage calculator with flexible years

If you decide to refinance consider working with a lender that offers more flexible terms. Your mortgage can require.

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

For an exact quote please contact one of our mortgage brokers by calling 1300 889 743.

. Mortgage Payoff Calculator with Extra Payment Recurring Irregular Both Example 3. 30 years is the most common mortgage term. Try the desktop mortgage calculator today.

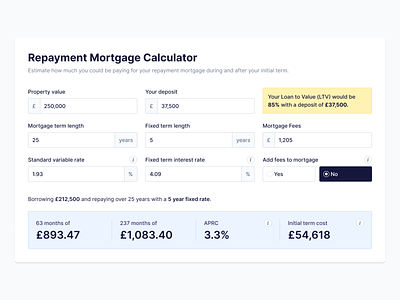

After a few years become standard variable-rate mortgages. Our LMI calculator asks for more information than other calculators you may find online. For example mortgages often have five-year terms but 25-year amortization periods.

This may go beyond the term of the loan. Amortization Period - The actual number of years it will take to repay a mortgage loan in full. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

Early Mortgage Payoff Calculator. This calculator is for information purposes only and does not provide financial advice. About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency.

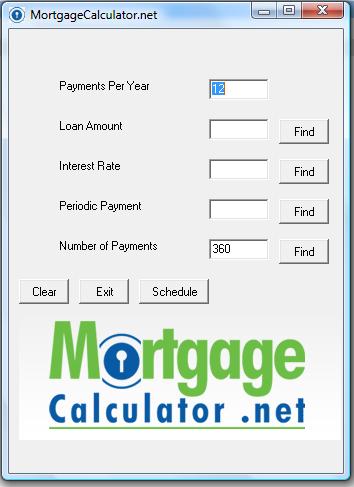

Mortgage Closing Date - also called the loan origination date or start date. Number of payments - typically 12 times the number of years. Free online mortgage calculator specifically customized for use in the UK including amortization tables and the respective graphs.

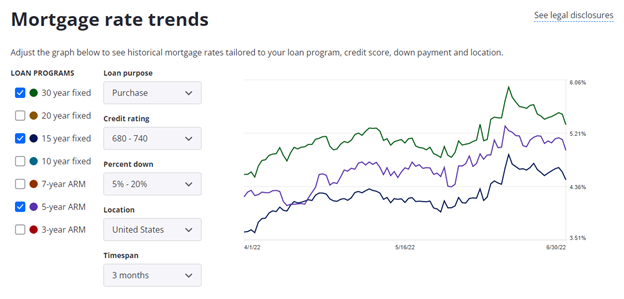

Traditional mortgages are limited to 15 and 30-year repayment schedules. Based on the example the 5-year fixed mortgage with the highest rate is offered to borrowers with 90 LTV which is 305 APR. For example a 30-year fixed-rate loan has a term of 30 years.

Scotiabank Mortgage Calculator Mortgage details. To talk to one of our team at ANZ please call 0800 269 4663 or for more information about ANZs financial advice service or to view our financial advice. The Loan term is the period of time during which a loan must be repaid.

More 228 Adjustable-Rate Mortgage 228 ARM. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. The traditional period for amortization of a mortgage the time to pay it off is 25 years.

Fallon has taken a mortgage loan of an amount for her newly bought home. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. In this way it can give a more accurate result by.

First Payment Due - due date for the first payment. Found on the Set Dates or XPmts tab. Blake finds that after every 3 months he has to pay 289220 extra to pay off the loan in the next 10 years.

A flexible mortgage is a mortgage type that allows the borrower to overpay underpay or take a payment holiday from a mortgage. Confirming which lendersmortgage insurers are likely to accept your mortgage application. 10 years over 30 years Whats the Ideal Interest Rate to Refinance.

When it comes to calculating affordability your income debts and down payment are primary factors. Flexible Mortgage - A closed mortgage agreement does not provide. While your personal savings goals or spending habits can impact your.

Factors that impact affordability. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Over the past couple of years 76 to 78 of advances were for capital and interest.

If you only have a couple more years to pay your mortgage ex. This makes the calculator flexible fitting many different needs. We recommend seeking financial advice about your situation and goals before getting a financial product.

A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. Original Loan Terms Years. Alternative mortgage instrument AMI is any residential mortgage loan with different terms from a fixed-rate fully amortizing mortgage.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan. Here are her loan details. 15 vs 30 yr.

But if you reduce your LTV to 80 upon remortgaging you can obtain a 5-year fixed mortgage with 197 APR. The Canadian Mortgage Calculator is mainly intended for Canadian residents and uses the Canadian dollar as currency with interest rate compounded semi-annually. But this is done in periods of five years at a time though it is possible to pay the.

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float.

Downloadable Free Mortgage Calculator Tool

Simple Interest Loan Calculator How It Works

Interest Only Mortgage Calculator

Mortgage Calculator With Down Payment Dates And Points

Free Financial Calculators For Excel

Free Mortgage Calculator Download Easy To Use Calculator

Simple Mortgage Calculator Estimate Monthly Payments Moneyunder30

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Mortgage Calculator With Down Payment Dates And Points

Free Interest Only Loan Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Chart Amortization Schedule

How To Add A Mortgage Calculator In Wordpress Formidable Forms

Mortgage Calculator Designs Themes Templates And Downloadable Graphic Elements On Dribbble

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator With Down Payment Dates And Points

Downloadable Free Mortgage Calculator Tool

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide